The Unity Bank Plc - Providus Bank Merger: The Emergence of a Unique Lender and the Controversies Surrounding It.

The recent announcement of the merger between Unity Bank Plc, a nationally licensed bank, and Providus Bank Limited, a regionally licensed entity, has stirred up a whirlwind of discussions and opinions.

Introduction

The recent announcement of the merger between Unity Bank Plc, a nationally licensed bank, and Providus Bank Limited, a regionally licensed entity, has stirred up a whirlwind of discussions and opinions. With the Central Bank of Nigeria (CBN) granting regulatory approval for this corporate combination, reactions have been mixed. Some view it as a long-awaited strategic move, others see it as a mere consolidation of two minor players, while there are those who question the broader implications of this decision within Nigeria's banking regulatory framework.

Amidst the debates, a few critical points emerge, especially for those keeping a keen eye on the financial sector. This article seeks to explore the factors behind this merger, the historical context leading up to it, and the possible outcomes that could reshape the banking landscape.

Analyzing the Schools of Thought

Pro-Merger Perspective

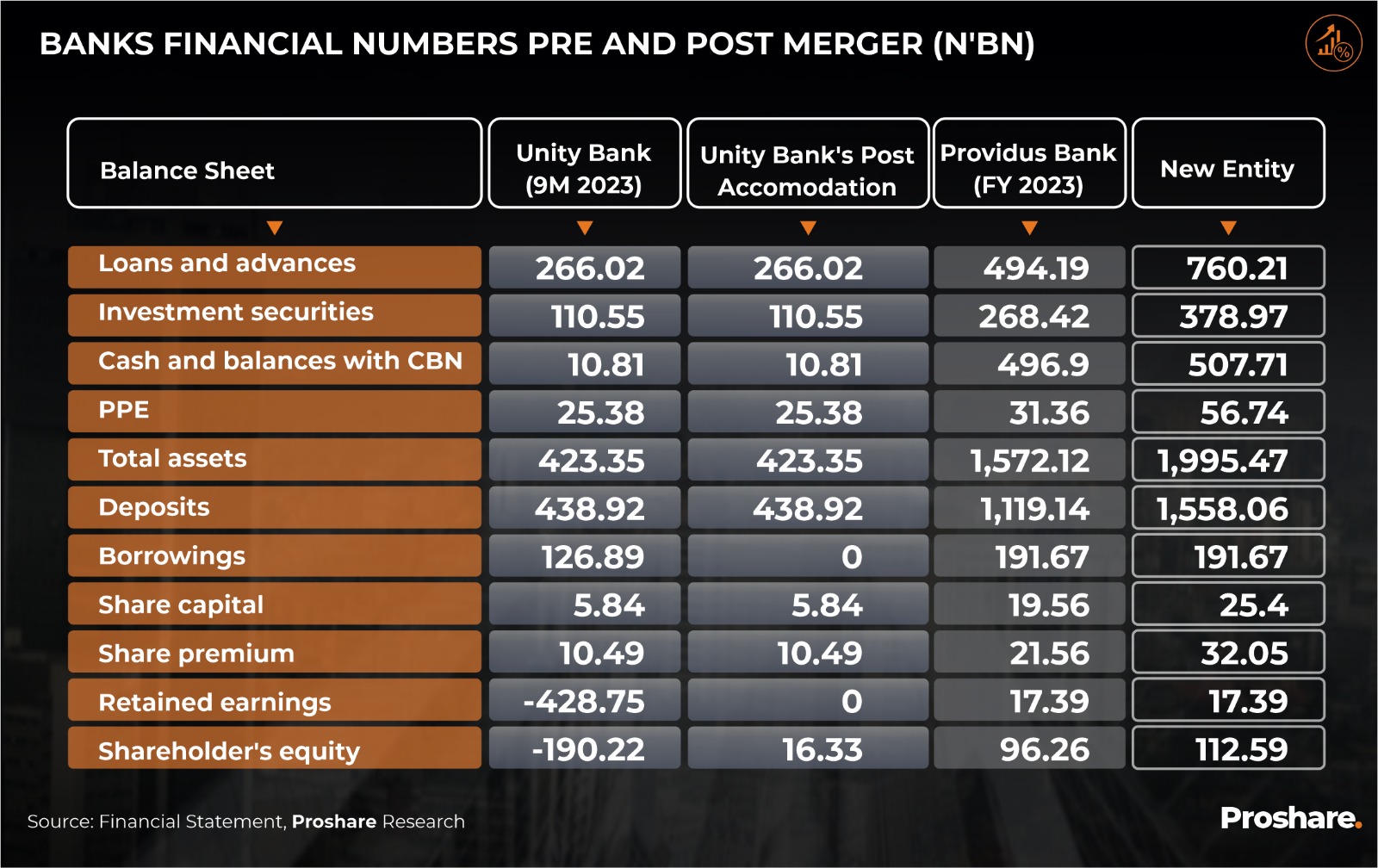

Supporters of the merger argue that combining Unity Bank and Providus Bank, with the backing of the CBN, could create a stronger competitor among the tier 2 banks. They believe that the new entity would be well-capitalized and could attract foreign direct investments, particularly due to the CBN's financial support of ₦700 billion. This infusion is expected to help the merged bank expand its loan portfolio and improve profitability while attracting lower-cost deposits.

The Skeptics' Viewpoint

On the other hand, critics argue that merging two relatively small banks will not result in a significant player, even with the CBN's capital support. They caution that the new bank's financial strength might only appear robust on paper, as it will be burdened by legacy loans. These loans would need to be offset by high-quality new assets, which could prove challenging to acquire.

Concerns Over Regulatory Discretion

A third perspective focuses on the perceived arbitrary nature of the CBN's interventions. Critics question the rationale behind the CBN's approval of the merger, especially given the unresolved issue of Unity Bank's 2023 audited financial statements. This school of thought raises concerns about the transparency and consistency of the CBN's regulatory actions.

The Broader Implications

The merger has also sparked discussions about the methodology and communication of banking supervision in Nigeria. A particular point of contention is the CBN's approval of the merger without first addressing Unity Bank's suspended listing on the Nigerian Exchange (NGX) due to its delayed audited financial statements. This raises questions about the basis on which the CBN approved the merger and whether the necessary financial conditions were met.

Moreover, the debate extends to the future trajectory of the merged entity. Will it remain a regional player, or could it potentially evolve into a nationally licensed bank with a broader impact on the financial sector?

Potential Outcomes of the Merger

Given the complexities of the merger, several potential scenarios could unfold:

-

Delisting of Unity Bank: Following the release of its results, Unity Bank might be delisted, with a scheme of arrangement put in place by the CBN.

-

National Licensing and Capital Raising: The merged entity may raise additional capital to secure a national banking license.

-

Attraction of a Larger Merger: The new bank could become an attractive candidate for a further merger with a larger lender aiming to expand its national or international footprint.

-

Consolidation as a Regional Bank: The merged entity might consolidate its position as a strong regional bank, focusing on its core market.

Strategic Considerations

While the benefits of the merger, such as financial stability and improved access to finance, are apparent, the success of the combination will depend on more than just merging operations. The integration process, governance structure, and ability to deliver competitive returns on equity are crucial factors that will determine the long-term viability of the new entity.

As the market watches closely, the key question remains whether the Unity Bank-Providus Bank merger can overcome the challenges and emerge as a sustainable and profitable player in Nigeria's banking sector.

Conclusion

In conclusion, while the Unity Bank-Providus Bank merger presents an opportunity for growth and transformation, it also brings with it significant challenges and uncertainties. The coming months will be critical in determining whether this corporate combination can achieve its strategic objectives and deliver value to stakeholders.